Digitalization has transformed the world of personal lines insurance, and the small commercial world is following suit.

Small commercial insurance agents and carriers are shifting away from labor-intensive quoting and sales processes and adopting technology tools that help them streamline how they do business.

The shift to digital is imperative for agencies to meet customer expectations. Today’s consumers are used to doing business online – and that includes small business owners. The Gartner Future of Sales 2025 report predicted that by 2025, 80% of B2B sales interactions will occur in digital channels.

Click here for more insights from the 2023 Agency Growth Study

Regardless of the type of insurance an agency sells, those that embrace digital technologies reap the benefits. Our 2022 Agency Growth Study found that highly digital agencies grow an average of 70% faster than agencies that use fewer digital tools.

The Liberty Mutual 2023 Agency Growth Study looked specifically at agencies that focus primarily on small commercial lines to learn how they are using digital to drive growth and remain competitive in a hard market. We found that fast-growing small commercial agencies are leveraging technology to streamline operations, inform strategy and generate leads.

In this report, we’ll dive into the digital practices and technology tools that the fastest-growing small commercial lines agencies are using.

Savvy agents view evolving technology as an advantage instead of a threat.

Every business has different risks, and commercial insurance can be complex and confusing for business owners. Independent insurance agents are trusted advisers to business owners navigating those complexities, bringing peace of mind by ensuring that businesses are properly covered.

Digital tools cannot replace the expertise that agents bring or the relationships they build with clients. But agents can lean on digital tools to make their work more efficient, enhance their knowledge and find new opportunities.

The trends driving change

Small commercial insurance processes have typically been highly manual and time-consuming. A report from Accenture found that underwriters spend up to 40% of their time on non-core and administrative tasks.

However, new technologies are making things more efficient. Digital tools are rapidly evolving as carriers, InsurTechs and innovative agencies drive digitalization in the small commercial space. These digital tools include commercial comparative raters, which allow agents obtain quotes from multiple carriers, and artificial intelligence tools, which use third-party data to prefill forms and predict coverages.

With the insurance industry facing a hard market, it’s more important than ever for insurance agencies to find ways to operate efficiently, meet customer needs and highlight the unique value they bring to clients. Technology tools can help.

Strategically implementing digital tools can help agents compete in an increasingly digital world. Small commercial clients want the expertise of an agent who can help them understand evolving risks and help them get customized coverage, but they also expect streamlined digital experiences.

The increased efficiency from technology tools can also be a game-changer for staff. Automating administrative tasks frees up agents to spend more time on tasks that add value, such as building client relationships or honing their expertise in a niche. In a time when the talent gap makes hiring a challenge, efficiently using staff time can take the pressure off of finding new talent.

Growing small commercial agencies are embracing digital

For the 2023 Agency Growth Study, the Liberty Mutual research team surveyed more than 1,100 independent insurance agency leaders and team members, including nearly 300 that focus primarily on small commercial lines.

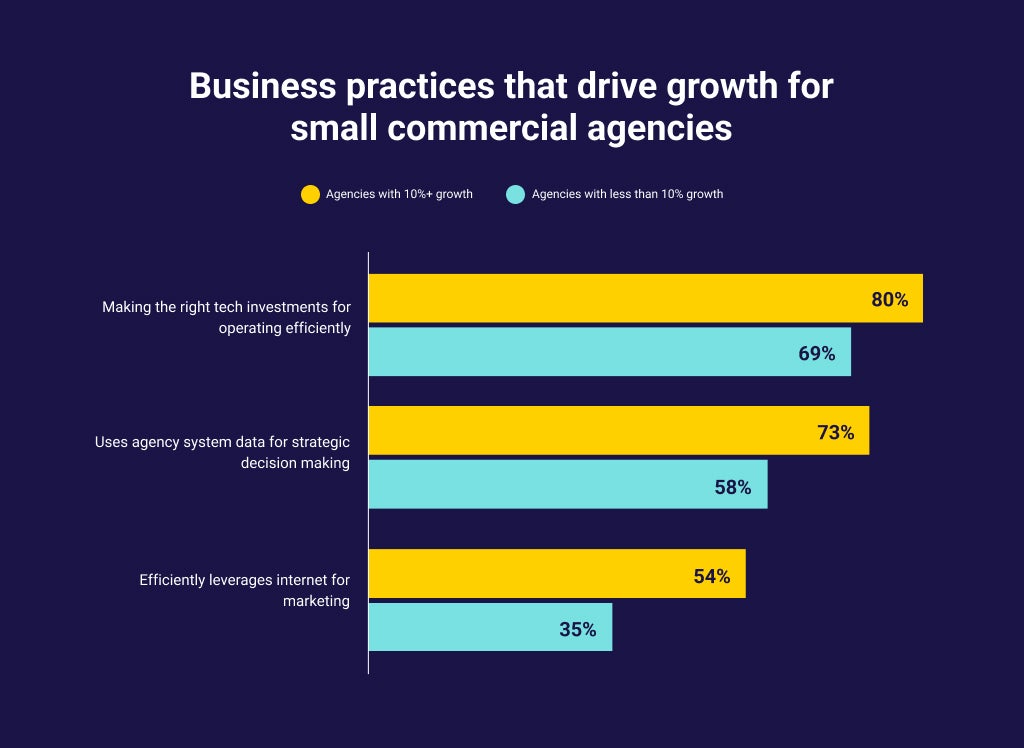

We asked respondents about their agency’s business practices, technology tools and average annual revenue growth to learn about growth-drivers. The research found that fast-growing small commercial agencies (those growing revenue by 10% or more year-over-year) are more likely than slower-growing agencies to be investing in technology to streamline operations, using data to inform strategy and leveraging digital marketing.

What sets small commercial agencies apart

Our research also compared the digital practices of small commercial agencies with those of agencies that focus more on personal lines.

The research found that independent insurance agencies use digital capabilities at similar rates regardless of their business focus. However, there were a few differences in the tools and channels that small commercial agencies use to engage with customers.

Small commercial agents are more likely than personal lines agents to use video calls with customers and prospects. Nearly 40% of agents that primarily sell small commercial lines reported using video calls, compared with just over 20% of agents who focus on personal lines.

When it comes to social media marketing, commercial agencies are more likely to use LinkedIn, while personal lines agencies are more likely to use Facebook.

Online quoting capabilities are less common in small commercial agencies than in personal lines agencies. Less than one-third of small commercial focused agencies allow prospects to start a quote on their agency’s website, compared with half of agencies that focus on personal lines.

Small commercial agencies are slightly ahead of personal lines agencies in adopting paperless processes, with 88% saying they provide digital copies of documents instead of printing.

The digital capabilities that drive growth

Our research analyzed more than 20 digital capabilities and found eight that were correlated with revenue growth for agencies that focus on small commercial lines.

These tools provide a starting place for agencies that want to improve or optimize their digital capabilities. However, as agents look at which capabilities to invest in, they should consider where they are in their digital adoption journey and which tools they already have in place. These tools range in complexity, and many build on other capabilities.

To illustrate this, we placed these tools along our digital hierarchy – from fundamentals, to modernizations, to innovations.

Want to learn where your agency falls on this spectrum? Take our quick assessment and get personalized results of which tools to explore next.

There’s no one-size fits all approach to technology in independent insurance agencies.

Agencies may need vastly different technology tools depending on how they want to do business. The key is to lead with strategy and let that inform technology decisions.

Used strategically, technology tools can help your agency provide flexibility for employees, make things easier for customers, emphasize the areas where humans add value, and more. By making strategic choices to meet your agency’s goals, you’ll set your agency up for continued success.”

The bottom line

As small commercial insurance technology continues to improve, small commercial lines will start to look and feel more like personal lines. Digital marketing and communication tools allow agents to reach a broader audience and do more business online. Quoting platforms and third-party data tools are making it easier for agents to get clients the coverage they need.

Our research shows that forward-thinking agencies are embracing digital business practices and tools to streamline processes, keep up with client expectations, and continue to grow and compete in a hard market.